As a member of the North Yorkshire Pension Fund (NYPF) you can pay AVCs through the Prudential, our in-house AVC provider. Paying in-house AVCs builds up a pot of money to provide additional benefits at retirement. You have your own account and can decide how the money is invested.

The main advantages of AVCs are as follows:

-

- Build up extra savings for retirement with an AVC

- Flexible contributions – you can choose how much you pay

- Your contributions get tax relief

- You can choose what funds to invest in, some with higher risks and greater potential rewards than others

- Use your AVC to get:

- up to 100% tax-free cash lump sum (conditions apply)

- additional LGPS income

- guaranteed regular income for life (an annuity)

- both lump sum and income

What are AVCs?

AVCs allow you to pay more to build up extra savings for your retirement.

When you save AVCs, you pay money into a separate AVC plan in addition to the main Local Government Pension Scheme (LGPS). You build up a pot of money that you use to provide additional benefits to your main LGPS benefits.

You must take your AVC plan when you take your main LGPS benefits.

All local government pension funds have an arrangement with an AVC provider (often an insurance company or building society). You can invest money in funds managed by the AVC provider. These arrangements are known as in-house AVCs and are referred to as AVCs in this guide.

You have your own personal account that builds up over time, with the contributions you pay in. The amount in your account depends on how long you pay AVCs for, the impact of charges and how well the fund(s) you invest in perform. You choose how the money in your AVC plan is invested. Your AVC plan is an investment and the value can go down as well as up. You may not get back what you put in.

You can pay up to 100% of your pensionable pay (subject to other deductions made by your employer) into an AVC. Pensionable pay is the pay on which you normally pay pension contributions, typically it includes salary, wages and other payments, with some exceptions.

If you are interested in paying AVCs, you should contact the NYPF for further information. You may wish to get independent financial advice about starting an AVC.

Shared cost AVCs

A shared cost AVC (SCAVC) is an AVC plan arranged through the LGPS that both you and your employer contribute to.

Your employer may offer a salary sacrifice arrangement for shared cost AVCs. If they do, you would pay lower National Insurance contributions as well as getting tax relief on the AVC contributions. Your employer would also pay lower National Insurance contributions.

Not all employers offer a salary sacrifice scheme for AVC contributions. Check with your employer to find out.

How do AVCs work?

How much can I pay in?

You can pay up to 100% of your pensionable pay (subject to other deductions made by your employer) into an AVC.

Flexible contributions

You can choose to pay a fixed amount or a percentage of your pay, or both, into an AVC, as long as it does not exceed 100% of your pay.

AVCs are taken from your pay, just like your normal pension contributions. Deductions start from the next available pay period after you set up the AVC. You may change your contributions or stop paying AVCs at any time while you are paying into the LGPS.

You can pay AVCs if you are in the Main or 50/50 section of the LGPS.

Get tax relief

Your LGPS and AVC contributions are deducted before your tax is worked out, so, if you pay tax, you receive tax relief automatically through the payroll. Although most people will be able to save as much as they wish into an AVC, the amount of pension tax relief they can receive is limited. See the ‘Tax and your pension’ section further down for more information.

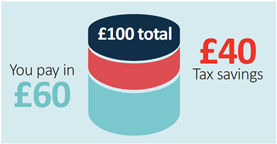

How the tax relief works

AVC contributions are taken from your pay before tax. Any money you would normally pay as income tax automatically goes into your AVC pot instead. If you pay tax at a higher rate, your tax savings will be higher. If you do not earn enough to pay tax, from the 2024/25 tax year onwards, the government will make ‘top-up’ payments directly to you. We expect HMRC to make the first of these payments in 2026.

| Basic rate taxpayer | Higher rate taxpayer | |

| A £100 investment in your plan costs you £60 | A £100 investment in your plan costs you £80 | |

|

|

How you save with an AVC

The AVC provider will set up your own personal account. Your account builds up over time with your contributions and any investment returns you make. The amount in your account will depend on how long you pay AVCs for, the impact of charges and how well the fund(s) you invest in perform.

You choose how the money in your AVC plan is invested. The investments on offer will have different risk levels, the higher the risk, the higher the potential rewards. The lower the potential rewards, the lower the risk.

You may be able to spread your investments (and risks) over a number of investment areas such as equities (shares), bonds, property and cash. Each have their own risks and potential rewards.

As with all investments, the value may go up or down and you may not get back what you put in.

What can I do with my AVC?

This section outlines how you can use your AVC plan in the LGPS and the option of transferring it to a different pension arrangement.

When you take your main LGPS benefits, you can use your AVC to:

Buy a regular income paid for the rest of your life

You can use your AVC plan to buy a lifelong, regular income, known as an annuity. This annuity is guaranteed to be paid for as long as you live. Annuities offer different features that may be of interest to you, such as improved terms if you are in poor health and annual increases to keep up with the cost of living.

When you buy an annuity, you can usually take some of your AVC plan as a tax-free lump sum at the same time. An annuity is paid completely separately from your LGPS benefits.

The amount of annuity depends on several factors, such as interest rates and your age. Generally, the older you are when you take out an annuity, the higher the income you will get.

You also have some choice over the type of annuity. For example, whether you want:

- a level annuity that provides a higher income to start with, but the payments stay the same for life.

- an escalating annuity that will start at a lower rate and increase over time to keep up with the cost of living.

- to provide for dependants’ benefits in the event of your death.

You don’t have to buy an annuity from your AVC provider. It is really important that you shop around to get the best ‘annuity rate’ based on your personal circumstances and the annuity features you’re looking for.

You must normally buy an annuity when you take your main LGPS benefits. However, if you left the LGPS before 1 April 2014, you can leave your AVC plan invested and use it later.

Buy a top-up LGPS pension

If you paid into the LGPS on or after 1 April 2014, you could use some or all of your AVC plan to buy extra pension from the LGPS. The extra pension you buy will increase in line with the cost of living.

If you take this option, your dependants will automatically get extra pension in the event of your death.

Take tax-free cash

You can take some or all of your AVC plan as a tax-free lump sum, provided that:

- The total tax-free lump sum is not more than 25% of the overall value of the benefits you are taking. The total lump sum is any lump sum you take from your main LGPS benefits plus the AVC lump sum.

- The total tax-free lump sum is not more than your lump sum allowance.

- The lump sum allowance is £268,275. It may be lower if you have already taken payment from a UK pension arrangement.

Buy extra membership in the LGPS

This only applies if you started paying into your AVC plan before 13 November 2001.

You may be able to convert your AVC plan into extra LGPS membership to increase your LGPS benefits. This will only be possible in certain circumstances such as flexible retirement, retirement on ill health grounds, or if you stop paying AVCs before you retire.

You will get a yearly pension of 1/60th of your final pay for each year of membership that you ‘buy’ with your AVC.

Leave your AVCs invested and use them later ( but only if you left the LGPS before 1 April 2014)

If you left the LGPS before 1 April 2014, you can choose not to take your AVC plan when you take your main LGPS benefits. You can leave your AVC plan invested and use it later. You must take it by age 75.

If you do not take your AVC plan at the same time as your main LGPS benefits, your options will be different when you do take it. You will only be able to take a maximum of 25% of your AVC plan as tax-free cash. You must use the remainder to buy an annuity.

If you paid into the LGPS on or after 1 April 2014, you must take your AVC plan at the same time as you take your main LGPS benefits.

Transfer your AVC fund to another pension scheme or arrangement

You can transfer your AVC plan to one or more different pension arrangements even if you are still an active member of the main LGPS scheme. If you were an active member after 31 March 2014, you can only do this before you take your LGPS pension. You must stop paying AVCs in any LGPS employment you hold before you can transfer your AVC plan.

If you hold more than one AVC plan, you must transfer all of your plans, even if they are held with different LGPS funds.

Different pension providers allow you to use your pension pot in different ways, including the option to buy regular income (an annuity). By transferring out to one or more different pension arrangements, you may be able to access options that are not available under the LGPS rules, such as:

- Take a number of lump sums at different stages. Usually, the first 25% of each cash withdrawal from your pot will be tax-free with the rest subject to tax.

- Take the entire pot as cash in one go. Usually, the first 25% will be tax-free with the rest subject to tax. Remember, it is possible to take your entire LGPS AVC plan as a tax-free lump sum, subject to certain conditions, if you leave it in the LGPS and take it at the same time as your main LGPS benefits.

- Provide a flexible retirement income. This is known as flexi-access drawdown. You are normally allowed to take a tax-free lump sum of up to 25% then set aside the rest to provide taxable lump sums as and when, or a regular taxable income.

How you take your AVC could affect how much tax you have to pay. The income from a pension is taxable; the rate of tax you pay depends on the amount of income that you receive from pensions and from other sources.

The different options mentioned above have different features, different rates of payment, different charges and different tax implications.

Some warnings and things to think about

As with all financial decisions, you should think about your own personal circumstances. You should also consider that money from a pension counts towards any income tax that you might have to pay.

Transferring your benefits from the LGPS could adversely affect your and any dependant’s eventual retirement income. If you are thinking of transferring your AVC plan, you should be aware that scammers operate in these markets and are after your pension.

You can read more about how to avoid pension scams in our Scams area and on the Pension Regulator’s website.

Get some advice

Deciding how to use your AVC plan is one of the most important financial decisions you are likely to make. We recommend that you get guidance and/or independent financial advice to help you decide which option is most suitable for you.

Pension Wise is a free, impartial service offered by the Government. If you are over 50, Pension Wise can help you understand your defined contribution pension options (eg AVCs). You can find out more by visiting the Pension Wise page of the Government’s Money Helper website, or by calling 0800 138 3944 to book a phone appointment or 0800 138 1585 to book a face-to-face appointment.

Because it is such an important decision, your local pension fund is not allowed to proceed with your application to take your AVC until you have either received guidance from Pension Wise or told them that you do not wish to take it. This is a legal requirement. Your pension fund will offer to book a Pension Wise appointment for you when you contact them about taking your AVC plan.

Independent financial advice

You can also get help choosing a financial adviser from the MoneyHelper website.

MoneyHelper offers free and impartial money advice, including pensions and retirement information.

The Financial Conduct Authority is the regulatory body for independent financial advisers.

The Personal Finance Society is the professional body for financial advisers. It provides access to appropriately qualified members who commit to the highest professional and ethical standards.

Unbiased is a website listing regulated and independent financial advisers, mortgage brokers, solicitors and accountants. It checks that everyone is registered with the Financial Conduct Authority (FCA).

Other considerations

What happens to my AVC if I take flexible retirement?

If your AVC plan started before 13 November 2001, your AVC contract will end when you flexibly retire. You will have to use your entire AVC plan in one of the ways described in ‘What can I do with my AVC?’ when you take flexible retirement.

If your AVC plan started after 13 November 2001, you can choose to take all or none of your AVC plan when you take flexible retirement. If you wish, you can continue paying AVCs.

What happens to my AVC if I leave before retiring?

If you leave before retirement, your contributions will stop when you leave.

The value of your AVC plan will continue to be invested until it is paid to you. You can transfer your AVC plan to one or more different pension arrangements or take it at the same time as your LGPS benefits.

What happens to my AVC if I die before taking it?

If you die before taking your AVC plan, it will be paid as a lump sum. Your AVC provider will pay the amount due to the NYPF who will then make payment in line with the Scheme rules.

If you have elected to pay AVCs to purchase life cover, a death in service lump sum and/or dependants’ pension will be payable.

I have previous AVCs with the LGPS. Can I transfer them if I re-join the LGPS?

The AVCs you have built up must normally be transferred to an AVC arrangement offered by your new LGPS fund, if you combine your main scheme benefits.

Other ways to increase your pension benefits

Buy extra pension in the LGPS – Additional Pension Contributions (APCs)

If you are in the main section of the LGPS, you can pay additional contributions to buy extra pension up to an annual limit (available on request). You can choose to pay for the extra pension by paying a lump sum or by spreading payment of the APCs over a number of complete years.

See the Increasing your benefits area and the national LGPS member website for more information on APCs.

If you pay tax, you get tax relief on all pension contributions up to 100% of your taxable earnings.

Freestanding additional voluntary contributions (FSAVCs)

These are similar to in-house AVCs but are not linked to the LGPS in any way. With FSAVCs, you choose a provider, usually an insurance company. You may want to consider their different charges, alternative investments and past performance when you do this.

You choose how much to pay into an FSAVC arrangement. You can pay up to 100% of your UK taxable earnings, less your normal pension contributions.

How much income your FSAVC will provide depends on how long you pay AVCs for, the impact of charges and how well the fund(s) you invest in perform. Your AVC plan is an investment and the value can go down as well as up. You may not get back what you put in. You can choose which investment route you prefer.

You can usually take up to 25% of the value of your FSAVC fund as a tax-free lump sum.

You can also pay FSAVCs to provide additional life cover. Your LGPS membership already gives you cover of three times your assumed pensionable pay if you die in service. Assumed pensionable pay is a notional pensionable pay figure used to ensure your pension is not affected if your pay is reduced during a period of sickness or injury, relevant child related leave or reserve forces service leave. You can increase this amount using an FSAVC or use the FSAVC to provide additional dependants’ benefits on your death.

This may be subject to satisfactory completion of a medical.

Personal or stakeholder pensions

You can make your own arrangements to pay into a personal pension plan or stakeholder pension scheme at the same time as paying into the LGPS. With these arrangements you choose a provider. You need to consider their charges, alternative investments and past performance when you do this.

It is advisable to get financial advice before taking out any form of additional pension saving.

AVCs and extra life cover

You can also pay AVCs to provide extra life cover. Your membership of the LGPS already gives you cover of three times your assumed pensionable pay if you die in service. You can pay AVCs to increase this and provide additional benefits for your dependants if you die in service. Any extra cover you buy will stop when you take your LGPS benefits or leave your job.

Tax and your pension

One of the benefits of saving with a registered pension scheme, such as the LGPS, is that you receive tax relief on the contributions you pay into the scheme. HM Revenue and Customs (HMRC) restricts the amount of tax relief you can receive.

Most people will be able to save as much as they wish as their pension savings will be less than the limit.

However, if you are thinking of making additional pension savings, such as AVCs, it is important that you are aware of the restrictions.

Limits on how much you can pay

There is no overall limit on the amount of contributions you can pay, but tax relief will only be given on contributions up to 100% of your taxable earnings in a tax year.

A different limit may apply if you pay into a ‘tax relief at source’ arrangement, such as a personal pension or stakeholder pension scheme.

Limits on how much pension you can build up

The annual allowance is the amount that the value of your pension benefits may increase by in a year without you having to pay a tax charge. From April 2023, the standard annual allowance is £60,000. If you are a high earner, your annual allowance could be lower due to ‘tapering’.

For money purchase arrangements, such as AVC schemes, the annual allowance you use is the total contributions paid by you, or on your behalf, over the tax year.

For defined benefits arrangements, such as the main LGPS scheme, the amount of annual allowance used is the growth in the value of your pension over the tax year.

If your LGPS pension savings in a year ending 5 April exceed the standard annual allowance, your LGPS pension fund will inform you by 6 October.

You can find out the value of the increase in your pensions saving for each of the last three years by asking the NYPF for a pension savings statement.

For more information about the annual allowance, including information on ‘tapering’ for high earners and the implications if you have taken defined contribution benefits flexibly on or after 6 April 2015, see the Tax page of the LGPS member website. You can find a link to a tool to check your annual allowance on that page.

You can also watch Pensions videos about the annual allowance and other LGPS topics on the LGPS member website.

Terms used in this guide

Pensionable pay

Pensionable pay is the pay on which you normally pay pension contributions. Typically, pensionable pay includes your normal salary or wages, bonuses, contractual overtime, non-contractual overtime, maternity, paternity, adoption, shared parental pay and parental bereavement pay, shift allowance and additional hours payments if you work part-time.

Assumed pensionable pay

Assumed pensionable pay is a notional pensionable pay figure used to ensure your pension is not affected if your pay is reduced during a period of sickness or injury, relevant child related leave or reserve forces service leave.

Disclaimer

This information is for employees in England or Wales and reflects the provisions of the LGPS and overriding legislation at the time of publication in April 2025. The Government may make changes to overriding legislation and, after consultation with interested parties, may make changes in the future to the LGPS. This information cannot cover every personal circumstance. In the event of any dispute over your pension benefits, the appropriate legislation will prevail. This page does not confer any contractual or statutory rights and is provided for information purposes only.